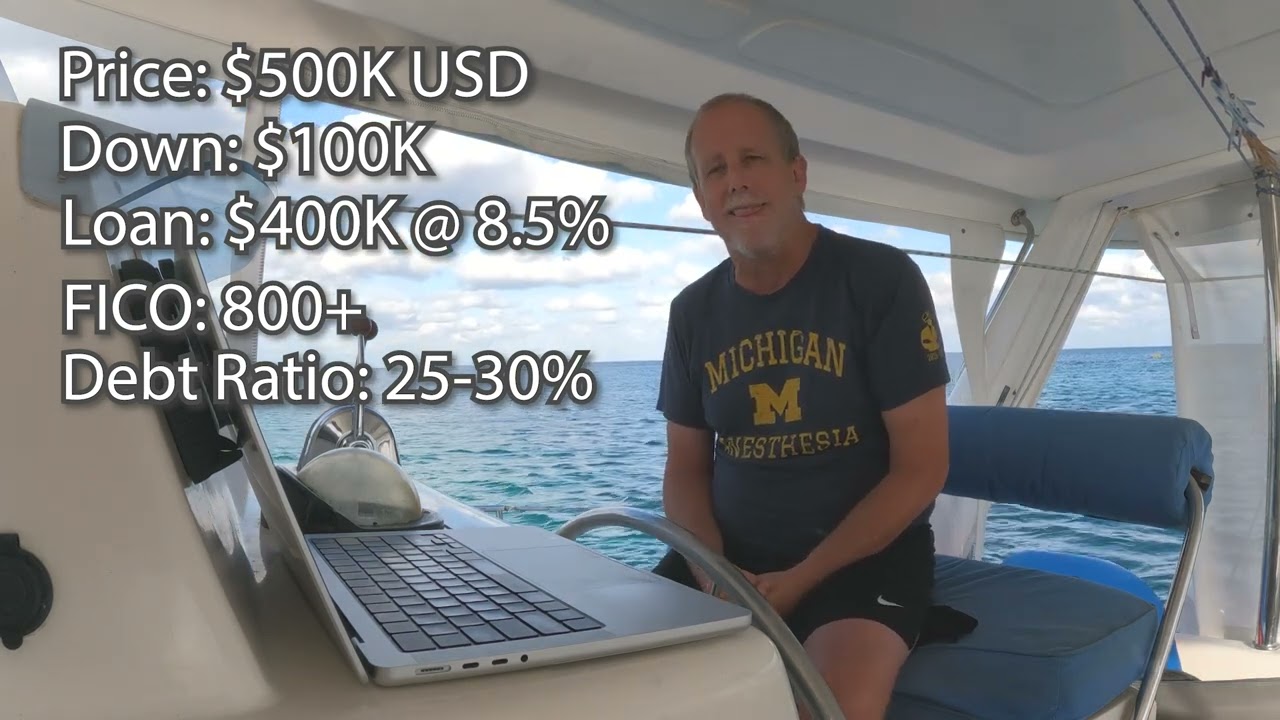

Împărtășim experiența noastră în obținerea unui împrumut pentru un catamaran uzat și subliniem unele dintre cerințele nebunești și dificile pentru obținerea unuia.

source

Adevărul urât despre finanțarea unui catamaran Bluewater uzat

20 thoughts on “Adevărul urât despre finanțarea unui catamaran Bluewater uzat”

Comments are closed.

terrific video! thank you so much. you are so brave

😂😂😂 Should be"' The ugly truth about financing anything. Until this administration and its masters get gone, expect it to get much worse.

BMO Bank of the West specializes in RV and boat loans. 15% down 20+ year financing. Credit check and insrurance is only requirement. Boat is the collateral. Close online. Took 7 days to close on $180,000 loan.

I thought it was funny that you mentioned buying a “blue water boat OR a catamaran.” 😂

I thought it was funny that you mentioned buying a “blue water boat OR a catamaran.” 😂

We had no trouble get a much bigger loan last year with a company called La Victoria. Also had good experience with Bank of the West too in the past

Thank you for the heads up. I have already started getting rid of my credit cards debt. I went from $23,000 to $829. FICO was 524 to 837. I also paid off my house and old car. College loan gone 35 years ago.

Borrowing to buy a used boat with a term more than 5 years doesn’t make much sense if you have no other assets, IMHO. If I bought a boat as a live aboard & I wanted to keep my home, I might borrow up to 50% of my home’s FMV with a term of no more than 10 years & rent it out as long as the rent net of tax covered the loan payments & realty taxes. With the proceeds of the loan, I’d allocate no more than 60% to the purchase & 40% to fund refits & repairs. So, on a $500k boat, I’d need $350k cash & a $250k loan – 150K towards purchase & $100k for refits & repairs. Then I’d want my after tax income to cover the $4-6k per month I budgeted to sail.

It has always been the case that, "Those who can get loans don't need loans. Those who need loans can't get them."

Banks like to do home loans because they can sell the loan in the secondary market, AND the collateral APPRECIATES. Boats depreciate, and repo boats super depreciate, so the collateral is heavily discounted and get high interest rates and high insurance costs….

Never heard of a loan requiring 800 or above FICO score.

We bought our boat with cash too. Sailing in Hawaii is awesome!

Break free and go sailing after 20 years of debt. Gonna continue refitting the Hurley 27 I paid like 4k for then go ocean sailing on that nice full keel. Financing something like this is wild.

Seems like the decline could also be based upon the increased risk you pose by changing from a successful land based lifestyle which was the environment in which you generated wealth to a nomadic one, while still needing to earn the money to pay the loan. Banks will underwrite any risk if the reward is high enough.

Great perspective. Thank you!

The whole idea is to break free 👍

8.5% might as well call it 10 with insurance for the loan so 400000 after 5 years will have paid 200000 in interest pretty much , might as well wait save the money pay cash as you did really , if you had that down payment and the reserve they were asking for that means after 5 years you will be sitting on 400000 cash for a boat , that buys a decent one imho

At 8.5% loan you should not buy this boat unless paying cash. This is a bad investment. Stupid!

My late father had an opinion about bankers:"They will happily loan you money, to buy an umbrella, on a sunny day. Be sure they will want the money back on the next rainy day"

'Bout sums them up I'd say!

If you want to throw your money away buy a Catamaran. People with more money than brains.